Browse International Markets: Offshore Company Formation Discussed

Browse International Markets: Offshore Company Formation Discussed

Blog Article

Whatever You Required to Understand About Offshore Company Formation

Navigating the intricacies of overseas firm formation can be an overwhelming task for numerous people and companies looking to broaden their operations internationally. By unraveling the layers of benefits, challenges, steps, tax ramifications, and conformity commitments linked with overseas company formation, one can obtain an extensive insight right into this complex subject.

Benefits of Offshore Company Development

The benefits of developing an overseas company are complex and can dramatically benefit companies and individuals seeking tactical monetary preparation. One essential benefit is the capacity for tax obligation optimization. Offshore firms are frequently subject to beneficial tax laws, allowing for lowered tax obligations and boosted earnings. Furthermore, setting up an overseas firm can supply asset protection by dividing personal possessions from service obligations. This separation can safeguard personal riches in case of lawful conflicts or economic obstacles within business.

:max_bytes(150000):strip_icc()/800px-ING_Group_structure-6e6ce02cb1104164b37dd278744adc9b.png)

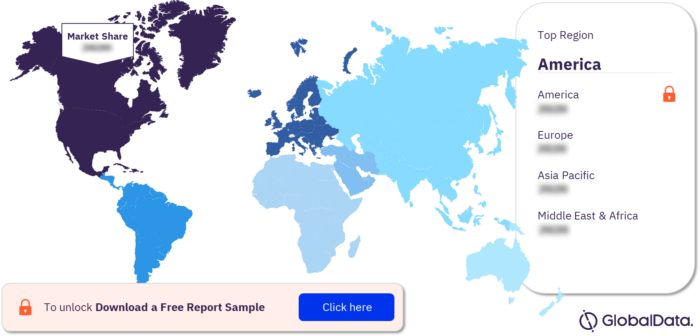

Moreover, offshore companies can assist in global organization procedures by offering accessibility to worldwide markets, diversifying earnings streams, and enhancing service trustworthiness on a worldwide scale. By establishing an offshore presence, organizations can use brand-new opportunities for development and expansion beyond their residential borders.

Usual Obstacles Faced

Despite the countless advantages related to offshore company development, businesses and people typically experience usual difficulties that can affect their procedures and decision-making procedures. One of the main difficulties encountered is the intricacy of international guidelines and compliance needs. Navigating differing legal structures, tax legislations, and reporting standards throughout different territories can be complicated and time-consuming. Making certain full conformity is important to stay clear of lawful concerns and punitive damages.

Another typical obstacle is the threat of reputational damage. Offshore companies are sometimes checked out with skepticism as a result of worries concerning tax evasion, cash laundering, and lack of openness. Managing and alleviating these perceptions can be tough, particularly in a significantly inspected global organization setting.

Additionally, establishing and keeping reliable communication and oversight with offshore procedures can be challenging as a result of geographical ranges, cultural distinctions, and time area differences. This can lead to misunderstandings, hold-ups in decision-making, and troubles in checking the performance of overseas entities. Conquering these challenges calls for cautious preparation, diligent threat monitoring, and a detailed understanding of the regulatory landscape in offshore jurisdictions.

Actions to Type an Offshore Company

Establishing an check this overseas firm includes a series of calculated and lawfully certified steps to guarantee a smooth and successful development process. The initial step is to pick the overseas territory that ideal suits your service demands. It is essential to conform with ongoing coverage and compliance demands to preserve the great standing of the overseas business.

Tax Obligation Implications and Factors To Consider

When forming an offshore company,Tactically navigating tax obligation implications is vital. Among the primary reasons individuals or businesses opt for offshore business development is to gain from tax benefits. It is vital to conform and comprehend with both the tax regulations of the offshore jurisdiction and those of the home nation to guarantee lawful tax obligation optimization.

Offshore firms are frequently subject to positive tax programs, such as reduced or no business tax obligation prices, exemptions on specific sorts of earnings, or tax obligation deferral choices. While these benefits can result in substantial cost savings, it is necessary to structure the overseas business in a means that aligns with tax obligation regulations to stay clear of prospective legal issues.

Furthermore, it is vital to take into consideration the ramifications of Controlled Foreign Firm (CFC) guidelines, Transfer Pricing guidelines, and various other international tax obligation laws that may influence the tax therapy of an offshore company. Looking for advice from tax obligation specialists or consultants with experience in overseas taxation can aid browse these complexities and ensure conformity with appropriate tax regulations.

Taking Care Of Conformity and Laws

Browsing through the detailed web of conformity requirements and regulations is necessary for guaranteeing the smooth operation of an overseas business, especially due to tax implications and factors to consider. Offshore territories usually have specific laws regulating the development and operation of firms to stop cash laundering, tax obligation evasion, and various other illegal activities. It is crucial for companies to remain abreast of these laws to avoid large fines, legal concerns, and even the go to my site opportunity of being closed down.

To manage compliance properly, offshore companies ought to select experienced professionals that recognize the worldwide requirements and regional regulations. These specialists can aid in establishing appropriate governance structures, maintaining exact economic documents, and submitting needed records to regulatory authorities. Routine audits and reviews ought to be carried out to make sure recurring conformity with all relevant legislations and laws.

Additionally, staying informed regarding changes in legislation and adapting approaches accordingly is essential for lasting success. Failing to adhere to laws can tarnish the track record of the firm and result in severe effects, highlighting the importance of focusing on compliance within the overseas firm's operational structure.

:max_bytes(150000):strip_icc()/offshore.asp-FINAL-1-941110e2e9984a8d966656fc521cdd61.png)

Verdict

To conclude, overseas firm development supplies various benefits, however additionally features obstacles such as tax obligation implications and conformity requirements - offshore company formation. By complying with the needed steps and considering all aspects of developing an offshore firm, businesses can take advantage of global opportunities while taking care of risks effectively. It is vital to remain educated concerning policies and stay compliant to guarantee the success and long life of the overseas company venture

By untangling the layers of benefits, challenges, steps, tax ramifications, and compliance commitments connected with offshore business development, one can acquire a detailed understanding right into this multifaceted subject.

Offshore companies are frequently subject to beneficial tax regulations, allowing for reduced tax obligations and raised revenues. One of the primary reasons people or organizations decide for overseas company formation is to benefit from tax obligation advantages. you can check here Offshore territories typically have certain legislations regulating the development and procedure of companies to protect against money laundering, tax evasion, and other immoral activities.In verdict, offshore company development supplies numerous benefits, but likewise comes with challenges such as tax effects and conformity requirements.

Report this page